The UK media has not tired of bombarding readers with news stories about the runaway nature of the London property market in particular, and the UK housing market in general, this year. As I have been looking to buy a bolt-hole in London, this strong price momentum has been particularly annoying, with properties literally flying off the shelves soon after being put up for sale.

This trend looks finally to be on the turn, despite continued reports of London seeing 19% price growth in the year to July, according to the Office for National Statistics.

This trend looks finally to be on the turn, despite continued reports of London seeing 19% price growth in the year to July, according to the Office for National Statistics.

RICS Survey Points to Big Slowdown

The Royal Institute of Chartered Surveyors' latest monthly survey for August highlights this London slowdown in a number of revealing charts (Figures 1-3):

1. Newly Agreed Sales Are Slowing Fast

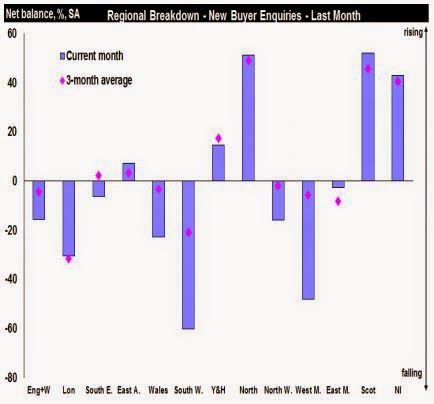

2. New Buyers Are Cooling Their Interest Given High Prices

3. Particularly in London

European House Prices Hardly Advance

While UK house prices have gained 12% in the year to July, the latest Knight Frank Global House Price Survey reveals that European house prices overall have only gained 2% over the last 12 months, with certain markets such as Spain still seeing falling prices. In fact in Europe, only Turkey (+14%) and Ireland (+12.5%) have seen faster house price growth than the UK. But remember, in the case of Ireland, that this rebound in house prices has only come after a terrible 50%+ fall in house prices during the Global Financial Crisis, a far cry from the UK situation today.

Can we really expect the UK housing market to continue to march upwards, even as affordability ratios deteriorate rapidly and force ever more 20- and 30-year olds live at home for longer in order to try to save up a deposit? And what if the Bank of England decides to begin raising its base rate, even if only gently? This could have a further negative impact on affordability to add to this price growth.

Seasonal Effects: Q4 is the Weakest Period of the Year for House Prices

I have looked at the quarterly variation in UK house prices from the Nationwide house price index going back to 1952: From this, it is quite clear that Q4 (October-December) is the weakest of the year from the point of view of house price momentum (Figure 4):

4. Q4 is on Average 0.7% Below Year Average House Price Growth

If we delve deeper and look by month using the Halifax House Price index data back to 1983, we see an even more obvious seasonal effect with August-January registering average house price growth well below the overall long-term average (Figure 5), with a similar if not exactly the same seasonal effect also found in Rightmove monthly asking prices (going back to 2001, Figure 6):

5. August-January Sees Pronounced Seasonal Weakness in House Prices

6. Rightmove Asking Prices Also See A Weak August-January Trend

Two Conclusions To Reach

- With discounts of achieved to asking prices currently widening according to Hometrack, it is time for homebuyers, especially in the pricier London and the South East regions, to be more discerning and to bid lower, particularly if a cash or non-chain buyer and thus able to complete relatively quickly.

- Estate agents like Foxtons (FOXT.L) and online property listing websites like Rightmove (RMV.L) and the recently-listed Zoopla (ZPLA.L) should see their premium valuations come under further attack as top-line growth inevitably slows along with overall housing market activity. I see a forward P/E of 22x for Rightmove and 27x for Zoopla as far too high when their core market is slowing, particularly as their dominance and cost to estate agents is spawning rivals like Agents' Mutual. Even estate agents are seeing their percentage-based fee structure under attack from fast-growing online estate agents charging a flat fee (e.g. £500) such as sellmyhome.co.uk. Rightmove and Zoopla could thus be interesting short candidates...

There will be a Time when Estate Agents Are Interesting Stocks

There will inevitably be a time to look at estate agents such as Foxtons and LSL Property Services (LSL.L), but I feel that this will be when they trade on single-digit P/Es and dividend yields of well above 5%. Foxtons may have nearly halved from its post-IPO high but has not hit these valuation levels yet, while LSL is not far away (9.8x forcast P/E and 4.9% dividend yield according to Stockopedia) and may warrant further attention in the months ahead.

But for the moment, I shall be biding my time and keeping a close eye on house price developments, in the hope of buying either a London property in the months ahead, or at least snapping up the shares of a bargain basement estate agent!

Edmund

Chart shows actual position of the market, as it signifies both growth and decline, it's all depend on proper analysis as regards Epic research.

ReplyDeleteAwesome Blog! Thanks for sharing this post. It is an interesting post for everyone. When i read about this post then got more information.In August 2018, the average UK home price was £ 226,000 in February after £ 22,000. I like this post.

ReplyDeleteManchester Property Market

property for sale liverpool city centre