Simple, common-sense investing - themes, strategies, stock tips, ETFs, Investment Trusts

Friday, 29 May 2015

Thursday, 28 May 2015

Make money from a strong pound at Marks and Spencer and Majestic Wines

IBTimes Video Link (click below):

This week, pound sterling hit its highest level against other major world currencies for over seven years (figure 1), judging by the Bank of England's Pound sterling index.

Figure 1: Trade-weighted pound back at highest since mid-2008

Source: Bank of England

This latest surge has been driven by the political certainty given by a Conservative general election victory, plus a following wind for the UK economy as:

- Unemployment continues to fall

- Retail sales surge higher (+4.7% year-on-year in April 2014)

- The domestic property market resumes its upwards march.

- Pound posts big gains against the euro and Aussie dollar

Of the major world currencies, the pound has gained against virtually all of them so far in 2015, save the Swiss Franc (figure 2).

Figure 2: Pound makes big gains against the euro and Australian dollar in 2015

Source: Bank of England

The biggest move has been the near 10% jump against the euro (from €1.29 at the beginning of 2015 to €1.41 currently).

The pound has also posted useful gains against the Australian dollar and Swedish crown too, with only the Swiss franc doing better this year so far.

Why should sterling stop here?

As long as the British economy keeps steaming along and the European Central Bank continues with its programme of bond buying (so-called Quantitative Easing, or QE), we could well see sterling return to the heady heights of €1.50 reached on several occasions between 2004 and 2007 (figure 3).

Figure 3: Pound hit over €1.50 several times 2004-07

Source: Bank of England

After all, the euro remains undermined by the ongoing Greek saga, while the extremist leftist party Podemos has made large gains in the local elections in Spain, underlining the political fragility of the established ruling parties across the eurozone and introducing yet further uncertainty.

Remember, if there is one thing financial markets hate, it is uncertainty – one area where the UK has a clear lead over its continental European cousins with a Conservative majority government now voted in.

How can we make money from a stronger pound?

One sector a canny investor should look at is the retail sector, given the majority of the goods sold on the UK high street tend to be imported. After all, a stronger pound means cheaper prices for imported goods, especially from the eurozone where the exchange rates have moved the most over recent months.

Food and drink is one big category where the UK imports a lot from the likes of Spain, France and Italy. Overall, the UK imports 40% of all the food consumed, much of it from our eurozone neighbours.

This should give a welcome boost to supermarket and upmarket food store chains such as Tesco (TSCO) and Sainsbury's (SBRY). I would focus more on two other retailers where I see potentially greater currency-related benefits.

The first is the venerable Marks and Spencer (MKS), which recently reported strong results. The retailer is continuing its slow transformation into primarily an upmarket food retailer along the lines of John Lewis's successful Waitrose chain.

Its Simply Food store format is enjoying a lot of success, and Marks and Spencer is focusing its new store programme on this format. While we may think fondly of the retailer as the nation's favourite purveyor of underwear, in actual fact food and drink now accounts for 57% of Marks and Spencer's UK sales.

The second retailer who could get a big profit boost from the stronger pound is wine warehouse chain Majestic Wines (MJW).

This £300m company is the UK's largest wine specialist merchant, with 213 stores selling wine by the case to 643,000 active customers.

French, Spanish, Italian and Australian wine imports in particular should all become cheaper in pound terms for Majestic to buy in the coming months and could deliver a useful profit bump.

Majestic should also see faster growth ahead following its recent acquisition of leading online business Naked Wines.

So go shopping for wine bargains thanks to that stronger pound, and why not add Marks and Spencer and Majestic Wines into your shopping basket while you are at it.

Labels:

Currency,

GBP,

IBT,

Majestic Wines,

Marks & Spencer,

Retail,

Video,

Weekly

Tuesday, 19 May 2015

HSBC and Co-op Bank do battle as sub-1% mortgage wars break out

International Business Times Video Link below:

Could the first sub-1% mortgage rate be around the corner? Actually, it is already here. While the Co-op Bank recently launched a 1.09% two-year fixed-rate mortgage (which will move back to the standard variable rate (SVR) at the end of the term), HSBC has beaten this with an initial rate of 0.99% on its two-year discount special mortgage.

It is hardly surprising then that existing homeowners are thinking about remortgaging to lower their monthly mortgage payments. Surprisingly enough, the SVR on mortgages has actually risen since 2010 and now stands at 4.5%.

Figure 1. Two and five-year fixed mortgage rates still falling

Source: Bank of England

The average two-year fixed mortgage rate has fallen to under 2%, while the average five-year fixed rate is under 3% (Figure 1). And if you shop around, you can now find sub-2% five-year fixed rates too.

Nearly one in six homeowners are thinking about remortgaging over the next six months, according to a recent Nottingham Building Society survey.

They are hoping to save on average £99 per month, or nearly £1,200 per year. This is all thanks to the ongoing mortgage price war, driving rates ever lower. Let's face it, with the Bank of England base rate at a historic 0.5% low, interest rates are likely to only go one way in the long-term – up.

So remortgaging with a multi-year fixed rate will at least insulate the homeowner against the risk of higher rates for the foreseeable future.

Average mortgage rate on outstanding mortgages

But how much is the average mortgage borrower paying at the moment? The Bank of England says "nearly 3.2%" (Figure 2).

Yes, this average rate has come down over the past five years, but it is still a long way from the current best two and five-year fixed and discount rates on offer today.

Figure 2. Average mortgage rate on outstanding mortgages still over 3%

Source: Bank of England

Let's say you are interested in remortgaging your house or flat. Where would you start and what should you watch out for?

Firstly, you can go the well-trodden route of checking out the online mortgage best buy tables at MoneySuperMarket.com, MoneySavingExpert.com or MoneyFacts.

Before going any further, it is probably a good idea to sit down with your existing mortgage provider to see what they can offer you.

Then if you're not satisfied, try the banks and building societies at the top of these tables. Or you could go to a specialist mortgage broker such as John Charcol or London & Country Mortgages.

But beware, some of these lowest interest rates come with catches: you may be hit with a high "arrangement fee" that can go as high as £1,499, or there may be penalties for early repayment. So be careful to examine the details.

Investing in the mortgage market: challenger banks, specialist lenders

There are some interesting ways to invest in a post-election pick-up in mortgage demand. Instead of looking at the Big Four UK banks, I would look to the new "challenger" banks that have recently been established, or look to specialist mortgage lenders.

Listed challenger banks that are making a splash on the savings and loans markets include Virgin Money (code VM.), Secure Trust Bank (STB), OneSavings Bank (OSB) or Aldermore Group (ALD).

Virgin, OneSavings and Aldermore have all recently listed on the London Stock Exchange and are growing their savings and mortgage businesses quickly as they take business away from the Big Four.

Otherwise, for a really focused mortgage growth play, you could look at the Paragon Group of Companies (code PAG). Paragon specialises in residential mortgages (such as buy-to-let), personal and car loans.

They are forecast to grow profits by more than 10% per year for the next two years and trade on a very reasonable valuation.

Bottom line: if you haven't remortgaged already recently, check out the current best remortgage buys and see if you can save on your monthly payments.

Thursday, 14 May 2015

CNBC TV Interview: Bonds - Expect more extreme moves

Edmund Shing, global equity portfolio manager at BCS Financial Group, says bond volatility is on the up.

Click on link below to watch the video clip:

Wednesday, 13 May 2015

On Bloomberg TV: Discussing the Economy

BCS Asset Management’s Edmund Shing and Mizuho International’s Riccardo Barbieri discuss Greece’s ongoing talks with its creditors and an IMF payment that the country made. They speak to Bloomberg’s Jonathan Ferro on “On The Move.” (Source: Bloomberg)

Bloomberg TV link:

Tuesday, 12 May 2015

Goodbye Labour mansion tax, hello Tory post-election property bonanza at Berkeley and Foxtons

International Business Times Video link (click below):

Could property be the big gainer from David Cameron's election win? Estate agent Foxtons and house builder Berkeley Group jumped 9%+ on 8 May. But why?

Clearly, the stock market has heaved a huge sigh of relief at the demise of the Labour Party. Now there is no fear of a mansion tax hitting London housing.

This is good news for house buyers at the £2m ($3m, €2.7m) plus price bracket, such as foreign buyers in London, who have been holding off any purchases up until now.

Equally well, with the risk of Labour's threatened rent controls now removed, the buy-to-let market could now see renewed activity.

Now that the Tories are in sole charge, they need to urgently tackle one of Britain's most pressing problems. London and the South East is the UK's economic heartbeat, but is desperately short of affordable housing.

House prices still on the rise – outside London

The Halifax house price index rose 1.6% between March and April, and 8.5% over the last year, for a yearly gain of nearly £20,000 on the average house (Figure 1).

Figure 1: UK house prices up by nearly £20,000 over the last year

Source: Lloyds Bank

Last year, London properties saw the fastest-rising prices. In contrast, it is the rest of the UK that has enjoyed stronger house price momentum over these last 3 months.

According to the Royal Institute of Charted Surveyors (RICS), London is one of the very few regions where house prices have actually fallen over the last 3 months (Figure 2).

Figure 2: House prices rising fastest in Northern Ireland

Source: Royal Institute of Chartered Surveyors

Four factors should drive a rebound in buy-to-let house purchases:

- Lifting of the threat of rent controls;

- High demand for rental properties (Figure 3);

- Falling mortgage interest rates: The Co-Op Bank are now offering a new 2-year fixed-rate mortgage at only 1.09%. This suggests that the first sub-1% mortgage rate could soon be here.

- Falling savings rates: your saved cash is worth less and less in the bank, increasing the attractions of alternative income investments.

Figure 3: National rental demand remains very high

Source: Royal Institute of Chartered Surveyors

All good for estate agents and house builders

What are the best ways to invest in the UK housing market? These are my two favourite housing-related industries:

Estate agents: Of course they buy and sell houses, and so make more money as house prices go up. But they also increasingly make money from the buy-to-let market, as they also act as letting agents.

House builders: who benefit from rising house prices as they can sell their newly-built homes for more, meaning higher profits.

My two favourite housing shares: Berkeley Group and LSL

I like the UK house builders as a group; they are all in general cheap, pay big dividends and are very profitable.

My favourite house builder is Berkeley Group (code BKG). It is focused on London and the South East of England, it is a generous income payer with a 6.4% dividend yield, and has been consistently very profitable over the last five years.

There are handful of listed estate agents in the UK. I like LSL Property Services (code LSL). LSL has two distinct sets of businesses:

- 539 estate agent branches under a number of brands, such as Your Move and Reeds Rains;

- Surveying and valuation services.

Both of these sets of businesses will make more money from a booming property market, whether from buying and selling or just from managing rented properties.

LSL is also a cheap stock and a reasonable income payer with a 3.7% yield; it is also consistently very profitable, with profits forecast to grow by 10% this year.

Post-election Friday was a good day for the estate agents and house builders; but there could be many more as the property market heats up again!

Labels:

Election,

estate agents,

House builder,

Housing,

IBT,

Property,

UK,

Video

Thursday, 7 May 2015

It's Apple v Microsoft in the technology boxing match of the century

International Business Times Video Link (click below):

We have just witnessed the so-called boxing match of the century: Floyd Mayweather versus Manny Pacquiao in Las Vegas. Reputedly grossing over half a billion US dollars, this is a financial windfall of the likes never seen before in professional sport.

But the Mayweather v Pacquiao bout has its long-running mirror in the technology arena, with American technology giants Apple and Microsoft slugging it out for the crown of the most valuable company in the world since the dawn of the new millennium.

Apple slugs it out with Microsoft

Back in 2000, Microsoft held sway with its dominance over the PC software market thanks to the prevalence of the Windows operating system and its Office software suite, wearing the "Technology Most Valuable" belt with pride.

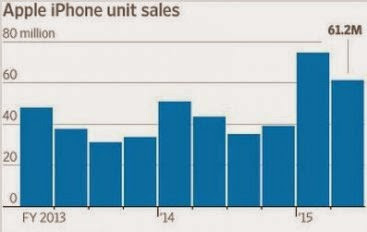

Figure 1. Global iPhone Volume Sales Remain Very Strong

Source: Apple

But in 2015, it is Cupertino-based Apple that is the Floyd Mayweather of the tech world –wearing the crown for being the most valuable company in the world as it is worth over $750bn (£495.7bn, €674.2bn) and nearly twice the market size of Microsoft.

Recent Apple results have underlined the pre-dominance of the iPhone 6 and 6+ models, even taking reportedly a 25% market share of the Chinese smartphone market in the face of incredibly fierce domestic competition from handset makers Huawei, HTC and Xiaomi.

In fact, Apple sold more iPhone 6 handsets in China than in the US over the past three months. The 61.2 million iPhones sold globally over the second quarter (Figure 1) served to dish up outstanding financial results at Apple, beating the expectations of financial analysts by a wide margin.

Unlike during the technology bubble in 2000, "old" technology names such as Apple (US code: AAPL) and Microsoft (US code: MSFT) are today substantially cheaper than the overall US stock market. Adjusted for the cash on the balance sheets of tech titans Apple, Microsoft and Google, you pay an average of under 12 times earnings for these globally dominant tech names; in contrast, you pay a much more expensive 18 times earnings for the overall US stock market (Figure 2).

Figure 2. Apple, Microsoft & Google: Much Cheaper than the US Stock Market

Source: Yahoo Finance. Note: Lower P/E ratio is cheaper

While Apple and Microsoft are cheap, they still offer solid prospective growth in both profits and dividends. The combination of cheap valuation and solid growth prospects in the technology sector could be a good reason to buy exposure. However, unless you have a stock market account that allows you to buy and sell US stocks, you may find it difficult to buy Apple or Microsoft shares directly.

Buying US tech stocks via a fund

In this case, buying a sterling-denominated exchange traded fund (ETF) or investment trust focused on US technology stocks may well be an easier option. These typically have substantial weightings in both Apple and Microsoft, given they are two of the largest stocks in the entire US stock market.

Five technology fund options are below (Figure 3), all with varying weightings in these two tech giants as well as the global internet and social media behemoths Google and Facebook.

Figure 3. UK-Listed Technology-Focused Exchange-Traded Funds,

Investment Trusts

Investment Trusts

Source: Company Factsheets

Focus instead on UK technology stocks

Instead of buying tech giants from the other side of the Atlantic, you may instead want to focus on technology closer to home. In that case, there are a number of UK technology stocks listed on the London Stock Exchange.

Narrowing down our focus to the technology hardware space, there are few large-cap stocks left for us to buy, following the recent takeovers of UK technology stocks CSR (being acquired by US semiconductor maker Qualcomm) and Pace (being acquired by US set-top box maker Arris).

ARM Holdings (semiconductor design, code: ARM), Imagination Technologies (semiconductor chip maker eg for Apple, code: IMG) and IQE (semiconductors, code: IQE) are three that remain listed in the hardware space.

In the UK software space, there are the likes of Sage (small company software, code SGE), Micro Focus (business software, code MCRO) and Playtech (gaming software, code PTEC).

But, overall, the listed UK technology sector is getting smaller and smaller, with companies being swallowed up by larger US competitors. This trend may be a good additional reason to buy into medium-sized and smaller UK technology businesses, aside from the growth attractions in technology.

So there you have it, two ways to play the technology growth theme. You can go the US route, either buying the likes of Apple or Microsoft directly or by buying a US technology fund.

Or there is the UK route, selecting from an ever shorter list of listed UK technology stocks, but perhaps benefiting from their status as potential takeover targets in a global sector.

Subscribe to:

Posts (Atom)