Simple, common-sense investing - themes, strategies, stock tips, ETFs, Investment Trusts

Wednesday, 14 October 2015

Bloomberg TV interview (Video): Why I like eurozone banks for Q4, even Deutsche Bank!

Bloomberg web link to Video below:

Bloomberg TV interview (Video): Why I like eurozone banks for Q4, even Deutsche Bank!

Budget airlines EasyJet and Ryanair soar toward investment success

IBTimes UK web link to article, video:

I recently flew back from Geneva to Paris after a long day of meetings with clients. But I didn't fly with either of the two flag-carrier airlines, Air France or Swiss. Instead, I chose to fly with EasyJet, in the process saving my employer hundreds of euros.

While I did arrive 15 minutes late in Paris, due to the airplane being late to arrive in Geneva in the first place, something else struck me. I was amazed at how full the flight was, with hardly a spare seat left on the aircraft. No chance of me getting the aisle seat I prefer.

What is more, so many people had opted, like me, to pay extra for speedy boarding in an effort to get a seat near the front of the aircraft, that in the end it didn't offer much of a benefit. Except to EasyJet of course, who made more money out of all of us.

That set me thinking – how well is the distinctive orange-liveried airline performing this year? Digging into the monthly passenger traffic statistics from the EasyJet website, the answer seems to be that they are doing very well indeed.

EasyJet enjoys strong passenger growth

Every month this year, EasyJet (UK code EZJ) has carried more passengers in Europe than over the same month in 2014

For the first 9 months of the year, EasyJet has on average carried 6.5% more passengers than over the same period in 2014.

Clearly, with Ryanair also carrying a record number of passengers in 2015, budget airlines are enjoying a banner year on the back of strong consumer confidence and a stronger pound sterling, which has improved British tourists' purchasing power abroad.

EasyJet's aircraft are fuller than ever

Profit growth isn't just about how many passengers are carried per year; what is at least as important is how full each flight is. This is expressed as 'load factor' - the percentage of an aircraft's seat capacity that is filled by a paying passenger.

In the case of EasyJet, the load factor is also improving this year over 2014: each month since March, EasyJet's load factor has been higher than the corresponding month in 2014. So EasyJet's profits this year should be better than last year's, not only because they are carrying more passengers, but also because each aircraft is on average fuller than last year.

Analysts following EasyJet are forecasting 20% earnings growth for this year, followed by 9% further growth in 2016.

Is EasyJet the only choice in budget airlines?

An investor who wants to capitalise on the growth in budget air travel across Europe actually has a number of investing options apart from EasyJet:

- Ryanair (UK code RYA) is the biggest budget airline in Europe by number of passengers carried. They claim to be the first airline to have carried over 10 million international passengers in one month, achieved in July 2015. They also achieved a record load factor in July of 95%.

- Wizz Air (UK code: WIZZ) is a budget airline that is listed on the London Stock Exchange, and which focuses on no-frills flights out of London Luton to Eastern Europe, including to Poland and the Czech Republic. This is a growth market given the large growth in UK immigration from Poland, Romania and other recent entrants to the European Union over the last few years. They carried nearly 2 million passengers in July 2015, and are seeing 20% year-on-year passenger growth this year.

- Air Berlin, listed in Germany, is a low-cost German airline operator. However, unlike Ryanair and EasyJet, Air Berlin is struggling against Ryanair, EasyJet and Lufthansa, and is projected to make a loss this year.

- Norwegian Air Shuttle, listed in Norway, is a low-cost airline operator that not only operates low-cost flights to and from Scandinavia within Europe, but which also operates long-haul budget flights to New York from London Gatwick. So next time you want to spend a long weekend in the Big Apple on the cheap, look up www.norwegian.com!

A final note on EasyJet: not only is it cheaper on valuation than either Ryanair or Wizz Air, but it also offers a decent 3.7% dividend yield and is sitting on over £400m of cash - both good supports to the share price. While normally I am not a fan of investing in airline shares, I would make an exception for EasyJet.

Edmund

Thursday, 2 July 2015

Idle Investor: Three simple strategies to beat the professionals (VIDEO)

Video Interview with Juliet Mann of news.markets

In this first video of a new series, the Business Book Club, fund manager Edmund Shing explains his three simple strategies to earn high returns and beat the professionals.

Shing, global equity portfolio manager at BCS Asset Management in Paris, outlines his simple, low-risk investing system that beats market indices and fund manager performance over the long term, but requires only a few minutes of investors’ time each month.

The strategy is detailed in his book The Idle Investor and Shing argues that even the laziest investor can achieve it. The Idle Investor includes three straightforward DIY strategies for long-term investing, Shing tells Juliet Mann. All you have to do is follow the simple rules.

Each method requires only a limited amount of time and they all make use of easily accessible, low-cost funds. Shing’s three strategies are: The Bone Idle Strategy, The Summer Hibernation Strategy and the Multi-Asset Trending Strategy.

Yet, argues Shing, being idle doesn’t mean being unsuccessful. “If you are looking for a straightforward investing method that lets you get on with your life while your money grows in the background, then become an Idle Investor,” he says.

On CNBC Today Talking About China: A Long-Term Play, But Not Yet!

Be patient if investing in China: Fund manager

Edmund Shing, global equity portfolio manager at BCS Asset Management, discusses China's economy and its recent easing policies.

Thursday, 25 June 2015

Forget Greek debt woes and buy into the European market recovery

International Business Times UK Video link:

I have to admit it - I am sick of being asked over and over again for my opinion on Greece.

Will it stay in the Eurozone or will it be forced to leave? Is the Greek drachma going to come back? And so on and so on...

Here is what I really think deep down: whether Greece stays in the Eurozone or not, I believe that you should be investing in Eurozone stocks anyway.

I have three reasons for believing this:

1. The European economy is improving and Greece is small

Greece is the 13th-largest economy in the EU (out of 28 member states) and only contributes 1.3% to the EU by Gross Domestic Product (GDP), the classical measure of economic output.

So it frankly hardly moves the needle compared heavyweights such as the UK, Germany, France and Italy.

European economies are improving. Not just the UK's, which we can all see through the lens of the employment and property markets, but also in Continental Europe. In Germany, unemployment rates remain at generational lows. Wage growth is now starting to pick up, giving employees more purchasing power.

At the same time, the cost of living in the UK is staying low, thanks to the fall in oil and petrol prices plus subdued food prices. The cost of eating is being depressed in large part by ongoing price wars between supermarket chains and discounters like Aldi and Lidl.

Finally, the weaker euro has helped boost exports from Germany, Ireland and Spain to the rest of the world (while the strong pound is making the UK's exports relatively more expensive).

All of this has boosted the Euro zone's economic growth rate, as measured by GDP.

Eurozone GDP growth has picked up

Source: tradingeconomics.com

2. Reforms are boosting both economies and company profits

Ireland, Spain, Portugal, France and Italy have made varying degrees of progress in lifting regulations and easing job-market rules, changes that can lead to better growth. Ireland and Spain are now the fastest-growing economies in the EU, and even Portugal is improving.

At the company level, investors are seeing a whole host of reforms too. Companies have become much keener on cost-cutting and are targeting their investments on good growth prospects. It has become somewhat easier to hire and fire employees, an essential reform to encourage companies to employ more people to boost sales and profit growth in the long-term.

This corporate strength is reflected in the very high levels of business confidence seen across the European Union today, with companies looking to invest for future growth.

European business confidence is at a high

Source: tradingeconomics.com

The result is that the profitability of European companies has surged over the past few years. Even banks, which have been under the regulators' cosh since the 'Great Financial Crisis' are now starting to see growth in profits, which is translating into growth in dividends too.

3. European shares are cheap

At 15 times price/earnings ratio, the European stock market is cheap relative to other large stock markets such as the US. Shares in countries such as Spain and Italy look particularly cheap. And European stock markets are also cheap relative to their own history, if you compare today to the last 30 years.

At the same time, European companies pay out an average dividend yield of well over 3%, which is an income which is not to be sniffed at in these times of near-zero interest rates.

With the improvement in the underlying Euro economy continuing, European companies should continue to produce strong profit growth; thus an attractive combination of growth and value, which is what experienced investors look for.

What to buy? The direct way via an exchange-traded fund

The easy way to buy into European value and profit recovery is through a fund: I would recommend a cheap exchange-traded fund (ETF) such as the db x-trackers MSCI EMU Index UCITS ETF (code: XD5S).

This is an ETF that is:

- cheap (they only charge investors a management fee of 0.25% per year);

- priced in pounds sterling (current price £18.09); and

- currency-hedged so that investors do not suffer from any weakness of the euro currency against the pound sterling.

What to buy? The indirect way via UK stock which is heavily exposed to Europe

The second option is to buy shares in a UK company that has a heavy exposure to Continental Europe, and which should thus benefit from future Euro area growth.

I would look at Sky (code: SKY). We all know and love Sky for providing us with satellite TV (namely sports, movies and of course not-to-be-missed series such as Game of Thrones), but Sky has also recently integrated Sky Deutschland (its German + Austrian equivalent) and also Sky Italia (Sky in Italy).

In all three countries, Sky is the dominant satellite TV provider. Sky is an excellent company which is dominant in a number of the largest countries in Europe. It will thus benefit from higher consumer spending in Continental Europe.

As an additional inducement, remember that the Rupert Murdoch-controlled US-based Fox network still owns 39% of Sky's shares, and have recently rebuffed two offers to buy this Sky stake from Vodafone and from France's Vivendi.

Perhaps Murdoch is thinking of buying out the 61% of Sky's shares he doesn't own in the near future?

All in all, the bottom line is that Greek concerns should not dissuade you from investing in European recovery, whether via an exchange-traded fund or via Sky.

Friday, 19 June 2015

Idle Investor Book Is Out!

Order from the publisher Harriman House: The Idle Investor (2015)

or from amazon.co.uk: The Idle Investor (2015)

Earn high returns and beat the professionals using 3 simple strategies

Are you tired of the paltry interest rates on offer at banks

and building societies? Are you are unsure where to begin when investing your

own money and concerned about shares given the two sharp drops since 2000?

Would you like to use a simple investing system that beats broad market indexes

and fund manager performance over time, while limiting the risk taken, and

requires only a few minutes each month? You could be an Idle Investor!

In The Idle Investor you will

find three simple DIY investing strategies for long-term savings. The methods

here are mechanical, so there is no need for you to figure out what to do each

month - you simply have to consistently follow the rules of the strategies.

Each of the methods requires only a limited amount of your time per month and

they all make use of easily accessible, low-cost index funds. The principles

behind why the strategies work and everything else you need to know to put them

into practice is explained clearly and with worked examples.

The three strategies are:

1. The Bone

Idle Strategy: Part of your portfolio is

allocated to shares and part to bonds. Adjustments to the portfolio are only

required on two occasions per year. The rest of the time you do nothing.

2.

The Summer

Hibernation Strategy: For part of the year your

portfolio is allocated to shares and for part of the year it is allocated to

bonds. Once again, adjustments to the portfolio are only required twice per

year. The rest of the time you do nothing.

3. Multi-Asset

Trending Strategy: A simple trend-following

method is employed to determine whether to hold your portfolio in shares or

bonds. For this strategy you will need to check your investments and make

adjustments once per month.

Each of the three Idle Investor strategies has been tested

for the period 1990 to 2012, with the result that they delivered average annual

returns ranging from 11% to 28%. By comparison, a buy-and-hold approach of

investing in UK shares would have delivered 8.5% per year over the same period.

The three strategies also limited the downsides experienced from stock market

falls.

If you are looking for a straightforward investing method

that will enable you to get on with your life while your investments earn money

in the background, become an Idle Investor.

Tuesday, 16 June 2015

UK goes mad over online shopping - BooHoo and Sports Direct worth an investment look

I admit it – I just love buying stuff on Amazon. I love the simplicity, the speed, the ease; such a contrast to actually having to go out and find a shop on the high street that actually stocks what I want, and at a price I am prepared to pay!

Clearly, I am not alone.

The UK is gripped by online shopping fever

Today, almost £1 in every £8 is now spent online in the UK (Figure 1), by over 42 million digital shoppers. Now that is quite a feat, particularly when you realise that only 4% of all food sales are done online.

Online now represents more than £1 in every £6 spent on non-food sales, according to the British Retail Consortium.

1: Over 12% of total retail sales are done online

Source: ONS

As you might expect, online sales are growing faster than retail sales in "bricks and mortar" shops.

Online shopping grew 13% over the last year (to April 2015; Figure 2), compared with overall retail sales growth of under 5% since April 2014.

2: Online retail sales up 13% in a year

Source: ONS

UK is the European leader of internet shopping

Did you know that we in the UK are in fact the world leaders in internet shopping?

This year, we are predicted to spend nearly £1,200 shopping online, even more than the average American online shopper and around 10% more than in 2014 (Figure 3).

3: UK shoppers spend an average of £1,174 online

Source: econsultancy.com

Delving into the top 50 ecommerce retailers in the UK, 30 of them are from the retail sector, while another 12 are in travel, transportation and leisure.

Some of the top e-tailers are immediately obvious to anyone who has not been living in a proverbial cave: Amazon, Apple iTunes, and eBay.

Online shopping via mobile phones and tablets is now the fastest-growing area of ecommerce. And the top UK mobile retail category for searches is fashion, in the form of clothing, apparel and accessories. 65% of smartphone users search for fashion items using their device, according to Econsultancy (Figure 4).

4: Fashion is the most popular mobile retail search

Source: econsultancy.com

Investing in UK online retail

In the UK, BooHoo (code BOO), Asos (ASC) and Sports Direct (SPD) are all direct beneficiaries of this move to buying sports and fashion clothing online, at the cost of more traditional high street clothing chains such as BHS and TopShop.

Out of BooHoo, Asos and Sports Direct, I am particularly keen on BooHoo and Sports Direct as good long-term online retail plays.

A quick check on the Alexa web ranking website gives a very positive first impression (Figure 5). BooHoo.com is certainly getting more popular relative to other online retailers.

5. BooHoo.com is becoming more popular, relative to other similar websites

Source: Alexa.com

What is more, BooHoo's 10 June trading update highlighted a 35% increase in sales for the 3 months to 31 May, with 3.3 million active customers worldwide (32% more than a year ago).

Very strong growth, backed by lots of cash which can be used to make further investments for future growth too.

All in all, this looks a rather attractive proposition to me at BooHoo's current 28p share price.

Sports Direct harness Click and Collect

Sports Direct's website makes great use of their brick-and-mortar chain of stores to offer a "click and collect" service. With Click and Collect, you first order your sports goods on their website, and then collect the parcel from your chosen local Sports Direct store once it has arrived.

Online sales are now over 14% of Sport Direct's total sales, but are growing at an 11% annual clip and are also helping to improve the company's profitability.

While you pay £4.99 for this delivery option with Sports Direct, you get a £5 voucher back to spend in store when you collect your order. So while in principle you pay nothing for delivery, it cleverly entices you to make another purchase from either the store or the website.

Conclusion: BooHoo and Sports Direct are two great ways to invest in the UK online shopping boom.

Labels:

boohoo.com,

IBT,

online shopping,

Retail,

sports direct,

UK,

Video,

Weekly

Friday, 29 May 2015

Thursday, 28 May 2015

Make money from a strong pound at Marks and Spencer and Majestic Wines

IBTimes Video Link (click below):

This week, pound sterling hit its highest level against other major world currencies for over seven years (figure 1), judging by the Bank of England's Pound sterling index.

Figure 1: Trade-weighted pound back at highest since mid-2008

Source: Bank of England

This latest surge has been driven by the political certainty given by a Conservative general election victory, plus a following wind for the UK economy as:

- Unemployment continues to fall

- Retail sales surge higher (+4.7% year-on-year in April 2014)

- The domestic property market resumes its upwards march.

- Pound posts big gains against the euro and Aussie dollar

Of the major world currencies, the pound has gained against virtually all of them so far in 2015, save the Swiss Franc (figure 2).

Figure 2: Pound makes big gains against the euro and Australian dollar in 2015

Source: Bank of England

The biggest move has been the near 10% jump against the euro (from €1.29 at the beginning of 2015 to €1.41 currently).

The pound has also posted useful gains against the Australian dollar and Swedish crown too, with only the Swiss franc doing better this year so far.

Why should sterling stop here?

As long as the British economy keeps steaming along and the European Central Bank continues with its programme of bond buying (so-called Quantitative Easing, or QE), we could well see sterling return to the heady heights of €1.50 reached on several occasions between 2004 and 2007 (figure 3).

Figure 3: Pound hit over €1.50 several times 2004-07

Source: Bank of England

After all, the euro remains undermined by the ongoing Greek saga, while the extremist leftist party Podemos has made large gains in the local elections in Spain, underlining the political fragility of the established ruling parties across the eurozone and introducing yet further uncertainty.

Remember, if there is one thing financial markets hate, it is uncertainty – one area where the UK has a clear lead over its continental European cousins with a Conservative majority government now voted in.

How can we make money from a stronger pound?

One sector a canny investor should look at is the retail sector, given the majority of the goods sold on the UK high street tend to be imported. After all, a stronger pound means cheaper prices for imported goods, especially from the eurozone where the exchange rates have moved the most over recent months.

Food and drink is one big category where the UK imports a lot from the likes of Spain, France and Italy. Overall, the UK imports 40% of all the food consumed, much of it from our eurozone neighbours.

This should give a welcome boost to supermarket and upmarket food store chains such as Tesco (TSCO) and Sainsbury's (SBRY). I would focus more on two other retailers where I see potentially greater currency-related benefits.

The first is the venerable Marks and Spencer (MKS), which recently reported strong results. The retailer is continuing its slow transformation into primarily an upmarket food retailer along the lines of John Lewis's successful Waitrose chain.

Its Simply Food store format is enjoying a lot of success, and Marks and Spencer is focusing its new store programme on this format. While we may think fondly of the retailer as the nation's favourite purveyor of underwear, in actual fact food and drink now accounts for 57% of Marks and Spencer's UK sales.

The second retailer who could get a big profit boost from the stronger pound is wine warehouse chain Majestic Wines (MJW).

This £300m company is the UK's largest wine specialist merchant, with 213 stores selling wine by the case to 643,000 active customers.

French, Spanish, Italian and Australian wine imports in particular should all become cheaper in pound terms for Majestic to buy in the coming months and could deliver a useful profit bump.

Majestic should also see faster growth ahead following its recent acquisition of leading online business Naked Wines.

So go shopping for wine bargains thanks to that stronger pound, and why not add Marks and Spencer and Majestic Wines into your shopping basket while you are at it.

Labels:

Currency,

GBP,

IBT,

Majestic Wines,

Marks & Spencer,

Retail,

Video,

Weekly

Tuesday, 19 May 2015

HSBC and Co-op Bank do battle as sub-1% mortgage wars break out

International Business Times Video Link below:

Could the first sub-1% mortgage rate be around the corner? Actually, it is already here. While the Co-op Bank recently launched a 1.09% two-year fixed-rate mortgage (which will move back to the standard variable rate (SVR) at the end of the term), HSBC has beaten this with an initial rate of 0.99% on its two-year discount special mortgage.

It is hardly surprising then that existing homeowners are thinking about remortgaging to lower their monthly mortgage payments. Surprisingly enough, the SVR on mortgages has actually risen since 2010 and now stands at 4.5%.

Figure 1. Two and five-year fixed mortgage rates still falling

Source: Bank of England

The average two-year fixed mortgage rate has fallen to under 2%, while the average five-year fixed rate is under 3% (Figure 1). And if you shop around, you can now find sub-2% five-year fixed rates too.

Nearly one in six homeowners are thinking about remortgaging over the next six months, according to a recent Nottingham Building Society survey.

They are hoping to save on average £99 per month, or nearly £1,200 per year. This is all thanks to the ongoing mortgage price war, driving rates ever lower. Let's face it, with the Bank of England base rate at a historic 0.5% low, interest rates are likely to only go one way in the long-term – up.

So remortgaging with a multi-year fixed rate will at least insulate the homeowner against the risk of higher rates for the foreseeable future.

Average mortgage rate on outstanding mortgages

But how much is the average mortgage borrower paying at the moment? The Bank of England says "nearly 3.2%" (Figure 2).

Yes, this average rate has come down over the past five years, but it is still a long way from the current best two and five-year fixed and discount rates on offer today.

Figure 2. Average mortgage rate on outstanding mortgages still over 3%

Source: Bank of England

Let's say you are interested in remortgaging your house or flat. Where would you start and what should you watch out for?

Firstly, you can go the well-trodden route of checking out the online mortgage best buy tables at MoneySuperMarket.com, MoneySavingExpert.com or MoneyFacts.

Before going any further, it is probably a good idea to sit down with your existing mortgage provider to see what they can offer you.

Then if you're not satisfied, try the banks and building societies at the top of these tables. Or you could go to a specialist mortgage broker such as John Charcol or London & Country Mortgages.

But beware, some of these lowest interest rates come with catches: you may be hit with a high "arrangement fee" that can go as high as £1,499, or there may be penalties for early repayment. So be careful to examine the details.

Investing in the mortgage market: challenger banks, specialist lenders

There are some interesting ways to invest in a post-election pick-up in mortgage demand. Instead of looking at the Big Four UK banks, I would look to the new "challenger" banks that have recently been established, or look to specialist mortgage lenders.

Listed challenger banks that are making a splash on the savings and loans markets include Virgin Money (code VM.), Secure Trust Bank (STB), OneSavings Bank (OSB) or Aldermore Group (ALD).

Virgin, OneSavings and Aldermore have all recently listed on the London Stock Exchange and are growing their savings and mortgage businesses quickly as they take business away from the Big Four.

Otherwise, for a really focused mortgage growth play, you could look at the Paragon Group of Companies (code PAG). Paragon specialises in residential mortgages (such as buy-to-let), personal and car loans.

They are forecast to grow profits by more than 10% per year for the next two years and trade on a very reasonable valuation.

Bottom line: if you haven't remortgaged already recently, check out the current best remortgage buys and see if you can save on your monthly payments.

Thursday, 14 May 2015

CNBC TV Interview: Bonds - Expect more extreme moves

Edmund Shing, global equity portfolio manager at BCS Financial Group, says bond volatility is on the up.

Click on link below to watch the video clip:

Wednesday, 13 May 2015

On Bloomberg TV: Discussing the Economy

BCS Asset Management’s Edmund Shing and Mizuho International’s Riccardo Barbieri discuss Greece’s ongoing talks with its creditors and an IMF payment that the country made. They speak to Bloomberg’s Jonathan Ferro on “On The Move.” (Source: Bloomberg)

Bloomberg TV link:

Tuesday, 12 May 2015

Goodbye Labour mansion tax, hello Tory post-election property bonanza at Berkeley and Foxtons

International Business Times Video link (click below):

Could property be the big gainer from David Cameron's election win? Estate agent Foxtons and house builder Berkeley Group jumped 9%+ on 8 May. But why?

Clearly, the stock market has heaved a huge sigh of relief at the demise of the Labour Party. Now there is no fear of a mansion tax hitting London housing.

This is good news for house buyers at the £2m ($3m, €2.7m) plus price bracket, such as foreign buyers in London, who have been holding off any purchases up until now.

Equally well, with the risk of Labour's threatened rent controls now removed, the buy-to-let market could now see renewed activity.

Now that the Tories are in sole charge, they need to urgently tackle one of Britain's most pressing problems. London and the South East is the UK's economic heartbeat, but is desperately short of affordable housing.

House prices still on the rise – outside London

The Halifax house price index rose 1.6% between March and April, and 8.5% over the last year, for a yearly gain of nearly £20,000 on the average house (Figure 1).

Figure 1: UK house prices up by nearly £20,000 over the last year

Source: Lloyds Bank

Last year, London properties saw the fastest-rising prices. In contrast, it is the rest of the UK that has enjoyed stronger house price momentum over these last 3 months.

According to the Royal Institute of Charted Surveyors (RICS), London is one of the very few regions where house prices have actually fallen over the last 3 months (Figure 2).

Figure 2: House prices rising fastest in Northern Ireland

Source: Royal Institute of Chartered Surveyors

Four factors should drive a rebound in buy-to-let house purchases:

- Lifting of the threat of rent controls;

- High demand for rental properties (Figure 3);

- Falling mortgage interest rates: The Co-Op Bank are now offering a new 2-year fixed-rate mortgage at only 1.09%. This suggests that the first sub-1% mortgage rate could soon be here.

- Falling savings rates: your saved cash is worth less and less in the bank, increasing the attractions of alternative income investments.

Figure 3: National rental demand remains very high

Source: Royal Institute of Chartered Surveyors

All good for estate agents and house builders

What are the best ways to invest in the UK housing market? These are my two favourite housing-related industries:

Estate agents: Of course they buy and sell houses, and so make more money as house prices go up. But they also increasingly make money from the buy-to-let market, as they also act as letting agents.

House builders: who benefit from rising house prices as they can sell their newly-built homes for more, meaning higher profits.

My two favourite housing shares: Berkeley Group and LSL

I like the UK house builders as a group; they are all in general cheap, pay big dividends and are very profitable.

My favourite house builder is Berkeley Group (code BKG). It is focused on London and the South East of England, it is a generous income payer with a 6.4% dividend yield, and has been consistently very profitable over the last five years.

There are handful of listed estate agents in the UK. I like LSL Property Services (code LSL). LSL has two distinct sets of businesses:

- 539 estate agent branches under a number of brands, such as Your Move and Reeds Rains;

- Surveying and valuation services.

Both of these sets of businesses will make more money from a booming property market, whether from buying and selling or just from managing rented properties.

LSL is also a cheap stock and a reasonable income payer with a 3.7% yield; it is also consistently very profitable, with profits forecast to grow by 10% this year.

Post-election Friday was a good day for the estate agents and house builders; but there could be many more as the property market heats up again!

Labels:

Election,

estate agents,

House builder,

Housing,

IBT,

Property,

UK,

Video

Thursday, 7 May 2015

It's Apple v Microsoft in the technology boxing match of the century

International Business Times Video Link (click below):

We have just witnessed the so-called boxing match of the century: Floyd Mayweather versus Manny Pacquiao in Las Vegas. Reputedly grossing over half a billion US dollars, this is a financial windfall of the likes never seen before in professional sport.

But the Mayweather v Pacquiao bout has its long-running mirror in the technology arena, with American technology giants Apple and Microsoft slugging it out for the crown of the most valuable company in the world since the dawn of the new millennium.

Apple slugs it out with Microsoft

Back in 2000, Microsoft held sway with its dominance over the PC software market thanks to the prevalence of the Windows operating system and its Office software suite, wearing the "Technology Most Valuable" belt with pride.

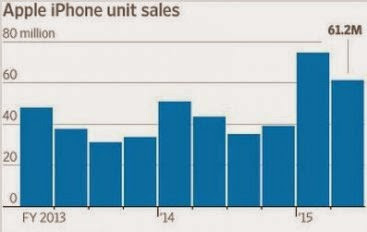

Figure 1. Global iPhone Volume Sales Remain Very Strong

Source: Apple

But in 2015, it is Cupertino-based Apple that is the Floyd Mayweather of the tech world –wearing the crown for being the most valuable company in the world as it is worth over $750bn (£495.7bn, €674.2bn) and nearly twice the market size of Microsoft.

Recent Apple results have underlined the pre-dominance of the iPhone 6 and 6+ models, even taking reportedly a 25% market share of the Chinese smartphone market in the face of incredibly fierce domestic competition from handset makers Huawei, HTC and Xiaomi.

In fact, Apple sold more iPhone 6 handsets in China than in the US over the past three months. The 61.2 million iPhones sold globally over the second quarter (Figure 1) served to dish up outstanding financial results at Apple, beating the expectations of financial analysts by a wide margin.

Unlike during the technology bubble in 2000, "old" technology names such as Apple (US code: AAPL) and Microsoft (US code: MSFT) are today substantially cheaper than the overall US stock market. Adjusted for the cash on the balance sheets of tech titans Apple, Microsoft and Google, you pay an average of under 12 times earnings for these globally dominant tech names; in contrast, you pay a much more expensive 18 times earnings for the overall US stock market (Figure 2).

Figure 2. Apple, Microsoft & Google: Much Cheaper than the US Stock Market

Source: Yahoo Finance. Note: Lower P/E ratio is cheaper

While Apple and Microsoft are cheap, they still offer solid prospective growth in both profits and dividends. The combination of cheap valuation and solid growth prospects in the technology sector could be a good reason to buy exposure. However, unless you have a stock market account that allows you to buy and sell US stocks, you may find it difficult to buy Apple or Microsoft shares directly.

Buying US tech stocks via a fund

In this case, buying a sterling-denominated exchange traded fund (ETF) or investment trust focused on US technology stocks may well be an easier option. These typically have substantial weightings in both Apple and Microsoft, given they are two of the largest stocks in the entire US stock market.

Five technology fund options are below (Figure 3), all with varying weightings in these two tech giants as well as the global internet and social media behemoths Google and Facebook.

Figure 3. UK-Listed Technology-Focused Exchange-Traded Funds,

Investment Trusts

Investment Trusts

Source: Company Factsheets

Focus instead on UK technology stocks

Instead of buying tech giants from the other side of the Atlantic, you may instead want to focus on technology closer to home. In that case, there are a number of UK technology stocks listed on the London Stock Exchange.

Narrowing down our focus to the technology hardware space, there are few large-cap stocks left for us to buy, following the recent takeovers of UK technology stocks CSR (being acquired by US semiconductor maker Qualcomm) and Pace (being acquired by US set-top box maker Arris).

ARM Holdings (semiconductor design, code: ARM), Imagination Technologies (semiconductor chip maker eg for Apple, code: IMG) and IQE (semiconductors, code: IQE) are three that remain listed in the hardware space.

In the UK software space, there are the likes of Sage (small company software, code SGE), Micro Focus (business software, code MCRO) and Playtech (gaming software, code PTEC).

But, overall, the listed UK technology sector is getting smaller and smaller, with companies being swallowed up by larger US competitors. This trend may be a good additional reason to buy into medium-sized and smaller UK technology businesses, aside from the growth attractions in technology.

So there you have it, two ways to play the technology growth theme. You can go the US route, either buying the likes of Apple or Microsoft directly or by buying a US technology fund.

Or there is the UK route, selecting from an ever shorter list of listed UK technology stocks, but perhaps benefiting from their status as potential takeover targets in a global sector.

Wednesday, 29 April 2015

After Shell, BG, Nokia and Alcatel, ITV and Indivior could join the takeover trail

IB Times Video Link:

KPMG says the merger and acquisition boom is back in 2015. Certainly, company takeover activity has been hotting up on both sides of the Atlantic these past few months – just think of Shell swallowing up BG in oil and gas, Nokia merging with Alcatel-Lucent in technology and FedEx buying up fellow Dutch logistics group TNT Express.

Figure 1. What factor will drive deal activity in 2015?

Source: KPMG 2015 M&A Outlook Survey Report

One of the main reasons for expecting more takeovers is the very high level of cash that large companies are holding, and the very low interest cost on company debt (Figure 1). With money burning a hole in corporate pockets, top executives want to go shopping for growth.

In trying to predict who could become the next takeover targets, we need to know the profiles of existing targets: which industries are seeing the greatest number of takeovers and takeover rumours, and what size of company is most likely to be susceptible to a takeover approach?

Technology, healthcare, media, insurance and oil and gas are ripe for consolidation

I see four industries as prime hunting grounds to search for potential takeover targets, given recent takeover and merger activity in recent months:

- Technology: Nokia is merging with Alcatel-Lucent in telecoms equipment, while US set-top box maker Arris is buying UK set-top-box maker Pace for $2.1bn.

- Healthcare: In generic drug making, Israeli global leader Teva has bid some $40bn in cash and shares for US generic drug rival Mylan. Novartis, the Swiss drug maker, has revealed recently that it is hunting for healthcare acquisition targets in the $2bn to $5bn range.

- Media: AT&T's acquisition of DirectTV in the US and Liberty Global's purchase of Belgian media company De Vijver Media NV highlight the consolidation occurring in the US-dominated broadcast media industry, with media content becoming increasingly valuable to cable and TV distributors.

- Insurance: Lloyd's of London insurers has been the focus for acquisition of late, with both Catlin and Brit Insurance bought up by larger North American insurers. We can also add the merger of close-end life assurer Friends Life with Aviva, highlighting the consolidation wave under way in insurance.

Interestingly, these same industries came top in the KPMG M&A survey too (Figure 2).

Figure 2. What factor will drive deal activity in 2015?

Source: KPMG 2015 M&A Outlook Survey Report

What size of company could be preferred for acquisition?

While the Shell-BG deal is huge buying up huge, mid-cap companies are generally more likely to become tasty bite-sized morsels for cash-rich mega cap rivals to buy up growth prospects, relatively easy to finance and without all the complications of combining two huge companies with wide-ranging and complicated operations.

Three potential UK mid-cap takeover targets

1 Indivior (Healthcare)

Indivior (UK code: INDV) is the former pharmaceutical division of cleaning products and food maker Reckitt Benckiser, spun off from Reckitt as an independent, UK-listed company at the end of 2014. Its principal focus is on medicines to treat drug dependency, most notably alcohol, heroin and cocaine addiction.

At a market capitalisation of £1.5bn, it is relatively small versus the UK industry giants GlaxoSmithKline, AstraZeneca and Shire. Furthermore, it remains substantially cheaper on a number of valuation ratios such as price/earnings than any of these larger drug companies. Potential acquirers could be larger US-based drug makers who already produce opioid addiction treatments – Actavis, Endo Health and Janssen Pharmaceuticals.

2 ITV (Media)

There has been a battle for broadcast media content globally in recent months, with persistent takeover rumours surrounding £11bn market capitalisation ITV (UK code: ITV). It has most recently popped up as a potential target for the likes of US cable operator giant Comcast, the largest company in the world by broadcasting and cable revenues.

These rumours have sent the TV share price, and thus valuation, rising substantially since November 2014, with ITV's jewel in the crown being its production arm ITV Studios, responsible for drama series such as Poldark.

3 Lancashire (Insurance)

Lancashire (UK code: LRE) provides "global specialty insurance", operating as a Lloyd's of London insurer like acquired competitors Catlin and Brit Insurance. Attractions include a low valuation, high profitability levels and a juicy dividend yield projected to be as high as 9.5% in the future.

Just like Catlin and Brit Insurance, Lancashire could be the next to fall prey to a US-based reinsurer looking to expand globally.

So these are three UK mid-cap gems that I like the look of from a fundamental basis, which could also become the subject of a share-price boosting takeover in the next few months.

Labels:

Healthcare,

Indivior,

Insurance,

ITV,

M&A,

takeovers,

Technology

Subscribe to:

Posts (Atom)