28/06/2013

Why I have not (yet) given up on stock markets for now

At times of volatility such as we have recently undergone, I find it helpful to consult a number of market trend indicators that have served me well in the past, and which have a relatively good track record in marking major trends in stock markets, plus potential turning points.

I have three such indicators that I favour:

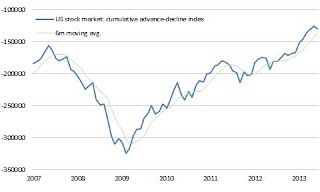

1. The Cumulative advance-decline indicator (The balance between how many US stocks have advanced during a given day, minus how many stocks have fallen, added up day by day from early 1965).

2. The New 52-week highs-lows indicator (The balance between how many US stocks have hit a new 52-week stock price high, minus how many have hit a new 52-week low in a given day, added up from start in 2003).

3. The High Beta/ Low Volatility oscillator (The S&P 500 High Beta index divided by the S&P 500 Low Volatility index), looking at this oscillator index versus its own 3-month moving average.

In each case, if the indicator is above its own moving average, then it gives a positive signal for stocks, if below then it gives a negative signal (meaning you should prefer bonds or cash to stocks).

What do these three indicators flag up as of yesterday?

1. Advance-Decline: Still Positive for Stocks

2. New Highs/New Lows: Also Still Positive for Stocks

3. High Beta/Low Vol: Still Thumbs up for Stocks

|

| Source: Unicorn, S&P Dow Jones Indices |

Conclusion: Despite the rocky ride in stocks, bonds and even precious metals over the last few weeks, the current uptrend in stock markets does not look to be over just yet, at least according to these three trend indicators.

Which sectors to prefer?

The four European stock market sectors still showing good relative strength (i.e. which are still outperforming the overall stock market) remain:

1. Healthcare (e.g. Roche, Sanofi)

2. Technology (e.g. Nokia, Alcatel)

3. Media (e.g. ProSieben Sat1, )

4. Insurance (e.g. Aviva, Delta Lloyd)

However I would be very wary of sectors which have les the stock market lower over the last few weeks, including:

1. Utilities (particularly electricity-related stocks)

2. Oil & Gas

3. Mining

4. Banks

Regional Preferences: Italy and Spain look vulnerable

And on a regional front, peripheral Europe is once again underperforming as their bond spreads over core Europe widen out once again, so be careful of:

1. Italy

2. Spain

On the other hand, Ireland continues to show impressive stock market outperformance, so I would stay with Irish stocks such as Ryanair and Greencore.

No comments:

Post a Comment